Protecting your home is vital, so finding mortgage protection insurance to suit your financial requirements is essential. Whether you need a new policy or want to review an existing one, it’s crucial to find the best mortgage protection policies for you at the best price.

Mortgage protection insurance assures you that your home and family are secure should the event of something unexpected happen.

What Is Mortgage Protection Insurance?

Mortgage protection providers offer term coverage designed to help family members cover the value of the mortgage with other financial needs upon the death of a loved one.

As well as paying off your mortgage in the event of your death, some additional features are included, or you can choose to add on.

Is mortgage protection the same as life insurance?

This is a common question, and the simple answer is that a life insurance policy can cover a mortgage, and specific policies are available. Mortgage protection insurance is unnecessary if you have enough life insurance to cover your mortgage in the event of your death. Only your mortgage provider will benefit from the policy, which you must sign over to them.

Types of mortgage protection

What is Reducing Term Cover?

As you decrease your mortgage loan, the amount covered by the policy decreases in proportion to the outstanding balance. In most cases, the policy will expire once the mortgage is paid off. It is the most common and least expensive type of mortgage protection. In general, your premium does not change, but the level of coverage does.

What is a Level Term policy?

The amount insured and the premium paid remain constant. This ensures that you have the same level of protection throughout the mortgage term. If you die before paying off your mortgage, the insurance company will pay out the original insured amount. This will pay off your mortgage, and any remaining balance will go to your estate.

What is a Life Insurance policy?

Existing life insurance policies can cover loans and mortgages if they are not already pledged or assigned. Additionally, any balance remaining after the mortgage is paid off will be transferred to your estate.

Is there a difference in cost between life insurance and mortgage protection?

Mortgage protection insurance is less expensive than life insurance. For example, a bank in Ireland may be more expensive than an independent broker. Lower mortgage premiums could save you thousands of euros over the life of the loan.

What does mortgage protection cover?

The standard coverage is that all policies will pay off your mortgage (to the bank) when you die. The common factor is that they pay out approximately 98 per cent of all death claims. So essentially, unless your claim is invalid, your mortgage protection policy will pay your mortgage in the event of your death.

Accidental death

This provides interim cover from when you submit your signed application and Direct Debit details until your application is approved or declined. A lump sum would be paid out if you were to die during that period.

Guaranteed insurability

This is where you can increase the level of cover or extend the term following specific changes in your circumstances without giving additional medical evidence, e.g. if you marry, have children, or buy a new house.

Terminal illness cover

If you’re diagnosed with a terminal illness and have less than 12 months to live, your policy will make payment in full at that time.

Children’s life cover

If in the regrettable event that your child dies during the policy term and is three months to 18 years old (or 21 if in education), a set amount will be paid, usually between €3,000 and €8,000.

When Is mortgage protection insurance a good idea?

Mortgage protection insurance is usually a good idea if you have a home mortgage. This is especially true if your death results in financial hardship for your spouse and/or minor children. Affordable mortgage protection leaves enough funds behind to ensure that your loved ones don’t have to worry about paying off the mortgage or covering the costs of selling the property when you are gone.

How user-friendly is the process of mortgage protection insurance?

The process of obtaining mortgage protection should be stress-free. Once you provide your preferred broker with your personal information and medical history, they give the relevant advice and then send you various quotes to consider.

Once you’ve decided, the application process is completed online with a digital signature, eliminating the need for postage/printing. Next, the broker communicates with the client about the policy and its progress.

What to look for when choosing the best mortgage protection policy

The critical thing to remember when looking for a mortgage protection policy is that everyone’s needs differ, so you need to consider what features will be helpful to you.

Shop around for quotes, this could save you hundreds of euros per year, so it’s worth the short time that it takes

Find one that suits your budget. Finding a policy within your monthly budget will affect your claim, and a fixed monthly budget is essential.

Don’t limit your choices

The bank you got your mortgage through may not offer the best policy or cheapest rate if you have your mortgage protection policy arranged directly by them.

For instance, the Bank of Ireland has a long-standing relationship with New Ireland, so if you request mortgage protection insurance from the Bank of Ireland, they will only quote you the rate from New Ireland. As a result, the policy may not be the most suitable deal for your circumstances.

Can I change my protection cover?

Even if you obtained mortgage protection insurance from your bank, a broker can review the policy and find a more suitable and cheaper policy for you in many instances.

How do I choose the best mortgage insurance protection companies

Like your mortgage, term policies last for a specific period and are a more affordable option than permanent policies.

When choosing your policy, it is always wise to discuss with your provider what is included. They will inform you about product features and optional benefits and discuss your pricing comparisons.

What are the costs and price comparisons I should consider?

While some Mortgage protection policies can start from as little as €10 a month, it is essential to ensure you get the protection you need. Therefore it is always wise to be aware of the things that can affect the cost of your premium.

Where do I buy my mortgage insurance cover?

By buying your mortgage protection insurance from your mortgage lender, you are limiting your options and may pay more. Therefore, it is better to shop around.

Which cover is cheaper?

If two people are on the mortgage, it is usually cheaper to have a dual or joint policy. A single cover, of course, is cheaper than a joint cover. The policy you choose depends on your particular circumstances.

Will health issues affect my policy?

If you smoke or have any pre-existing conditions, you must declare them as these factors can affect your risk and your premium.

How much can I expect to pay?

You will pay more if your mortgage is higher. The mortgage protection insurance policy you choose will also influence the price. Look at the price comparisons between a reducing term or level term policy.

Does the term of the policy affect the cost?

The length of the term determines the overall cost, and therefore it is higher if the policy is for a more extended period. If you switch providers, the policy must run for the whole or remaining mortgage term.

What about add ons?

One of the most common add ons with a mortgage protection insurance policy is serious illness cover. You are protected if you happen to be diagnosed with one of the illnesses you listed in your mortgage protection policy. Serious illness cover means you decide on an amount of your mortgage protection cover you want to be paid out.

Is there a limit on what I decide to have paid out?

This can total up to 100% of your mortgage protection policy. However, if you make a claim, your cover will reduce by the amount paid out, with any balance being paid in the event of death during the term.

If you need to add serious illness cover, this will increase the cost of your policy. Therefore, it is always advisable to shop around for the best mortgage protection insurance quotes.

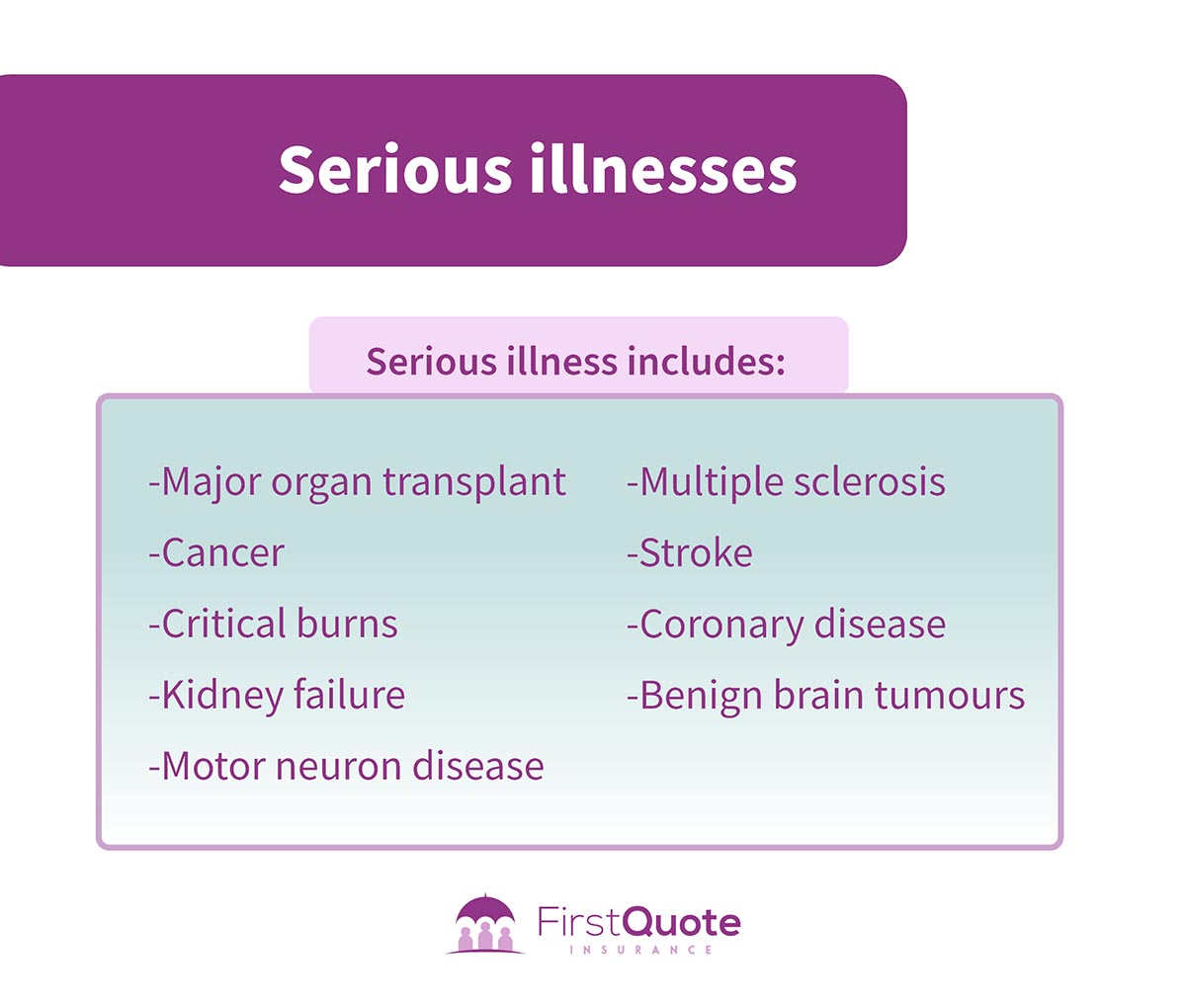

What illness does a serious injury policy cover?

While not all policies cover the same illnesses. Those most commonly covered by providers include:

- stroke,

- some cancers,

- heart attack,

- kidney failure,

- blindness,

- coronary artery disease,

- severe burns,

- major organ transplant,

- motor neuron disease,

- severe burns, and brain damage tumour.

What are the benefits of serious Illness cover?

Serious illness means you need time to recover without the added worry about mortgage payments, medical bills or other expenses, as your cover can help with those. You don’t have to worry about your family if you are out of work for an extended period. They will be protected with a tax-free lump sum if you cannot work.

Do I need a serious illness policy

Although you are not legally required to have serious illness insurance in Ireland, it is worth considering if you are not in paid employment or have no other health coverage. If you have a mortgage, dependants, loans or are self-employed, having a serious illness policy will give you some peace of mind.

Will my age affect the cost?

Youth is on your side here, as the younger and healthier you are, the less the cost of your policy will be. Therefore you are considered less likely to make a claim.

Should I consider Mortgage Protection brokers?

Many people pay much more than is necessary each year, so using a broker makes sense. A good broker will compare quotes and benefits from Ireland’s primary Mortgage Protection providers. Then, once they have found the right policy for you, they will guide you through the process, keeping you updated throughout.

How do I choose the best broker?

Suppose you have decided to go with a broker based on their professional knowledge. One of the first questions to ask them is how many of the mortgage protection providers they deal with. If they deal with several major providers, this will ensure they are getting the best price/policy for you.

Do They Offer Financial Advice?

A broker may make the process easier by wading through the confusing jargon of the Mortgage Protection insurance. This is especially useful if you have complexities or medical issues that need consideration. In this case, talking to a broker who can offer independent advice on the best insurer to approach for your scenario is invaluable. In addition, they can ease choosing your mortgage protection policy.

Mortgage protection insurance providers in Ireland

In addition to banks, several insurers and financial brokers provide mortgage protection.

In addition to banks, several insurers and financial brokers provide mortgage protection. In Ireland, there are five major mortgage protection providers.

Mortgage protection insurance is offered by all of the leading insurers in Ireland. While there may be some subtle differences in some policies, they are all fairly standard for the most part. These differences can depend on your specific circumstances.

How do I find the best price and save money?

Pricing is not always the most important factor, but over 60% of people in Ireland are paying too much for mortgage protection insurance. So it is essential to shop around to find the best mortgage insurance provider to suit your budget.

The answer to the question is, who provides the best mortgage protection insurance in Ireland?

Of course, it depends on your requirements before putting the cover in place. That’s why our expertly trained advisors offer advice that will help you find the best option, that will save you money and ensure that you are fully covered when something goes wrong.

Need help with mortgage protection?

If you have any questions regarding mortgage protection, why not make an inquiry below and a member of our team will be in touch for a free consultation.

Why Choose Aspect Life?

Best Cover For Less

Fast & Easy Process

Expert Friendly Staff

Personalised Financial Advice